Appliance warranty company vs home warranty: What’s the Best Way to Protect Your Home?

Appliance warranty company vs home warranty: What’s the Best Way to Protect Your Home?

Appliance insurance is similar to a Home Warranty plan in that it protects you from unexpected costs when your home systems or appliances break down. Covers what traditional homeowners insurance doesn't cover: Wear and tear on home systems, like water heaters, built-in microwaves, and HVAC units.

Appliance warranty plans can reduce the stress and expense of home repairs. If your appliances are nearing the end of their useful life or you want to simplify home maintenance, an appliance warranty could be a good investment.

Having available Home protection levels, electrical domains, and quick combination levels is an important understanding that adapts and requires the Home guarantee. This contains understanding:

* The age and useful life of your home systems and equipment.

* The cost of uninsured home appliance repairs.

* The total cost of home appliance insurance, including service contract costs, fringe benefits, and service charges.

* What Home Appliance Insurance Doesn't Cover, Including Past Damages

* All maximum limits for replacement of covered items

What can home appliance insurance do for me?

An appliance protection plan offers a number of benefits.

Coverage beyond home insurance

If you buy, receive, or need to buy a new home or appliance, you may need to purchase some type of insurance to cover equipment malfunction or unexpected damage. With all the options available, from appliance insurance to manufacturer's warranties to home insurance, it is important to understand the different levels of coverage and what exactly is included in each protection plan. Here is a description of each option.

Appliance Insurance / Appliance Warranty Plans

Similar to how an automatic auto parts and systems warranty extension would work, these are optional service contracts that cover the repair or replacement of critical systems and equipment. * These are generally 12-month contracts with an annual contract fee and a service fee. Home appliance insurance can be offered as a supplement to your home insurance, while a guarantee is offered through a separate provider, such as Choice Home Warranty.

Manufacturer's guarantee

This is a warranty generally associated with the purchase of a system or device that covers the repair or replacement of that particular item. The coverage offered usually lasts for one year and is only valid for the first owner.

Home insurance

This is a mandatory policy that protects against accidental disasters, theft, or vandalism. You pay an annual fee and a deductible, and the insurance pays the additional costs.

Appliance warranty plans can be important financial protection for appliances that are not covered by your home contents or manufacturer's warranty. These may include:

* Large Home Systems: HVAC, Electrical Systems, and Garage Door Openers

* Plumbing: toilet tank, water heater, and circulation pumps

* Appliances: Washer and Dryer, Dishwasher, Refrigerator, and Garbage Disposal

* Amenities: additional cooling equipment, pool and spa, and well pump

Peace of mind

According to the US Energy Information Association estimates that 96% of families have microwaves, 82% and 79%, respectively, have a washing machine and dryer, and 59% have a dishwasher.

Without the protection of a home warranty plan, you are responsible for repairing or replacing any of these household items, which can add up quickly. Manufacturer warranties can help reduce these costs, but you will likely have to rely on the cost of labor, parts, materials, and possible replacements when terms expire.

Appliance protection plans give you peace of mind that if your home device or system fails, you won't have to pay hundreds of dollars at a time or call to find the right service provider. You can simply report the problem and pay the service fee, and we have an authorized service technician to repair or replace your equipment within 48 hours.

Cost savings

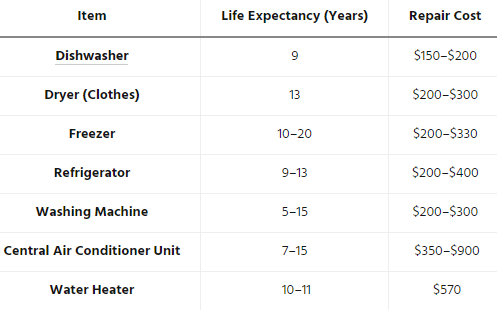

Appliance insurance or another protection plan can save you money on the repair or replacement of dozens of insured items. Consider the life expectancy of common appliances as estimated by the International Association of Certified Home Inspectors and Sears Home Services.

Let's say your refrigerator has an estimated maximum useful life of 13 years. Presumably, if your refrigerator depreciates, there will be at least $ 200-400 in repair costs over the next six years. When it's time to buy a new appliance, expect an additional $ 1,079 and $ 1,709 for energy-efficient refrigerators, according to Consumer Reports estimates.

With an average purchase price of $ 1,244 plus repair costs of $ 250, you could spend between $ 1,444 and $ 1,544 over the next six years repairing your existing refrigerator and eventually buying a new one.

* Life expectancy: 13 years

* Repair cost: $ 250 (average)

* Replacement cost: $ 1,244 (average)

* Total cost of repair and replacement: $ 1,244 to $ 1,544

* Choice Home Warranty Appliance Maintenance Agreement - Less than $ 1 per day

When you add other equipment, the cost of maintaining a home quickly exceeds the annual service contract fee, which costs between $ 319 and $ 894 for the average American homeowner.

Most appliance insurance companies offer service contracts that cover the cost of your refrigerator, washer, dryer, and many other popular appliances, which can save you a significant amount of money over the life of your appliances.

Appliance insurance can also make your home more attractive to potential buyers by increasing the sales price or reducing the time your home is on the market. Because home warranty plans are prepaid, prospective buyers can be assured that they won't be unpleasantly surprised with an expensive equipment breakdown or repair bill when they buy the home.

What does home appliance insurance cover (and what doesn't)?

The total cost of repairing or replacing your insured items depends on where you live and the type of insurance you purchase. To understand the full cost of home appliance insurance, it is important to understand what is included (and what is not) in the appliance warranty.

The Better Business Bureau identifies several points to consider when deciding between appliance warranty plans. Realizing the scope and limitations of your home protection plan can help you make a smart and financially sound decision.

* Pre-existing damage - Most appliance protection plans don't cover pre-existing damage or damage caused by improper care.

* Maximum caps - Some appliance warranty plans limit maximum repair or replacement costs for items such as pool pumps or specialty systems such as geothermal energy.

* Upgrade Costs - A home warranty provider will not upgrade your appliances. You will likely have to pay the additional cost of upgrading a covered item if it exceeds the replacement cost.

* Replacement cost - When a device or system needs to be replaced, some warranty plans allow the replacement cost to be limited to depreciation rather than market value. Check with your home warranty company for exchange guidelines.

Who should buy an appliance cover?

When it comes to protecting your appliances and your budget, device coverage is extremely beneficial. It can save you time, money, and unnecessary stress, especially if you are one of the following people:

A new owner buying an old house.

An owner who doesn't want to spend more on faulty devices or systems.

A home seller looking to add value to the home.

If you are a home seller, equipment coverage can make your property more attractive to home buyers, especially if you are selling an older home. This gives the buyer security. If a device or system fails within the first week or month after purchasing a new home, the buyer will not have to pay outrageous (and unexpected) expenses for a repair or replacement.

Choosing the Right Home Appliance Insurance Provider

When choosing protection for your appliance, you need to ensure that your provider offers the comprehensive coverage that best meets your needs and budget. Here are some things to keep in mind when choosing the best home warranty companies:

* When a customizable sleeve is available. Unlike the Choice Home Guarantee, some providers do not offer optional coverage. Swimming pools, tubs, and treatment plants, for example, are not always included for potential coverage.

* When the terms and conditions are available. You don't want to go blind when buying a plan. The best companies share their contracts in advance so you know exactly what is and what is not.

* When there is work in addition to the covered parts. Oftentimes, the cost of labor can cost as much as the part, so make sure your supplier includes labor costs in their insurance plans.

* When customer service is reliable, responsive, and available 24 hours a day to process claims. You can't predict when your washing machine or refrigerator will stop working, so you need to make sure the supplier is available at all times.

When shopping for a home warranty plan for your devices, you need to make sure that you choose the best provider. Pay attention to the company's offerings, as well as its hidden fees, fringe benefits, and payment options.

Which appliance coverage plan is right for me?

The Balance estimates that the average homeowner should expect to spend 1% of their home's value on repairs or replacements each year, plus an additional $ 1 per square foot. This can mean a lot of money when a large system breaks. Consider the following:

$ 200,000 home: $ 2,000 + maintenance costs

$ 300,000 home: $ 3,000 + in maintenance costs

$ 400,000 home: $ 4,000 + in maintenance costs

As your home and appliances age, the cost of maintenance increases, and neglect of major repairs leads to a loss in the value of your home.

Repair or replacement costs are an expected part of the home, but there are inexpensive strategies that can help reduce the financial burden. A Choice Home Warranty appliance protection plan can reduce the stress of home maintenance and protect your finances.

No comments